Let’s be honest. Traditional accounting was built for a linear world. You know the drill: buy raw materials, make a thing, sell the thing, and then… well, hope the customer forgets about it when it ends up in a landfill. The books close, revenue is recognized, and the environmental cost is someone else’s problem.

But that model is cracking. A new wave of business—the circular economy—is gaining serious traction. And at its heart lies a radical shift: from selling products to selling performance, access, and outcomes. We’re talking Product-as-a-Service (PaaS). This isn’t just a sustainability trend; it’s a fundamental rethinking of value. And it throws a massive wrench into standard accounting practices.

Why Old-School Accounting Breaks Down

Imagine you’re a company that used to sell industrial washing machines. Your revenue hit the books at the point of sale. Simple. Now, you lease those same machines, maintain them, upgrade them, and take them back for refurbishment at the end of their lease. You’ve shifted from a transaction to a relationship.

So, what’s the big accounting headache? Well, everything.

- Revenue Recognition: You can’t book the full “sale” anymore. Revenue must be recognized over the life of the contract, as you deliver on your promise of performance. This smooths out cash flow on the income statement in a way that can look… strange to traditional investors.

- Asset Ownership & Valuation: Those washing machines? They’re probably still on your balance sheet as assets. You have to track their cost, depreciation, and—here’s the kicker—their residual value. What’s a 3-year-old, refurbished machine actually worth in a circular model? That valuation is tricky.

- Cost Capitalization: Initial costs for designing for durability, modularity, and easy disassembly are huge. Under standard rules, these might just be expensed, making your first few years look brutally unprofitable, even if the long-term model is a goldmine.

The core challenge is that accounting standards (like IFRS and GAAP) are still catching up. They’re built for clarity in a linear system, not the fluid, lifecycle-focused reality of circular and servitization models.

The Asset Conundrum: Your Balance Sheet Gets Heavy

This is perhaps the most tangible shift. In a PaaS model, your balance sheet gets… heavier. Literally. Physical assets you used to sell now stay with you. This increases your asset base and, typically, your debt (to finance all those assets). Key financial ratios—like return on assets (ROA) or debt-to-equity—can take a hit, at least initially.

It looks worse on paper, even if the business model is more resilient, generates recurring revenue, and builds deeper customer loyalty. Explaining this to stakeholders is a new kind of CFO poetry.

Valuing “Circularity” Itself

How do you account for the value of a recovered component? Or the cost savings from avoiding virgin material procurement? Or the brand equity gained from being a truly sustainable business? Honestly, much of this is still in the realm of management accounting and internal metrics—not the official financial statements.

Forward-thinking companies are creating shadow accounts or integrated reports. They track metrics like:

| Circular Metric | What It Tells You |

| Product Utilization Rate | How intensively assets are used (key for PaaS profitability). |

| Material Circularity Indicator (MCI) | Proportion of recycled/biobased content in products. |

| Cost of Recovery vs. New | The real economics of take-back and refurbishment programs. |

| Customer Lifetime Value (CLV) in PaaS | Often much higher than in transactional sales. |

A Practical Framework for Transition

Okay, so it’s complex. But you can’t wait for the standards bodies to figure it all out. Here’s a deal—a sort of playbook for navigating this transition in your finance department.

- Segment Your P&L. Don’t mush circular and linear revenue together. Split them out. This shows the true performance and growth trajectory of your new model, protecting it from the (potentially declining) numbers of the old business.

- Develop Internal Costing Models. Get granular on the costs of remanufacturing, reverse logistics, and product life extension. This data is gold. It informs pricing, contract length, and design decisions. It proves the model’s viability.

- Rethink Depreciation Schedules. If you design a washing machine to last 15 years with upgrades, depreciating it over 5 years is misleading. Match the expense to the actual economic life and use of the asset. This may require robust justification to auditors, but it’s crucial.

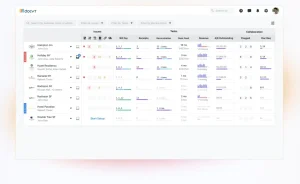

- Embrace New KPIs. Move beyond just revenue and profit. Track asset productivity, customer retention rates on service contracts, and the percentage of revenue from circular activities. These become your real north stars.

It’s a mindset shift for the whole finance team. From recorders of historical transactions to analysts of long-term value loops.

The Upside: It’s Not Just Compliance, It’s Insight

Sure, the initial driver might be pressure from regulators or environmentally-conscious consumers. But the hidden benefit of figuring this out? Unparalleled business insight.

When you track an asset across its entire lifecycle—from production to use, return, and rebirth—you see everything. You identify which components fail first, where design can be improved, which customers are most profitable over time. This feedback loop is a competitive moat. It turns your accounting function from a cost center into a strategic intelligence unit.

In fact, the granular data required for circular accounting makes you a better business, full stop. You’re forced to understand your products, your customers, and your impact in a way you never did before.

Looking Down the Road

The path isn’t perfectly paved yet. Standards will evolve. Tax implications—like who gets green incentives for a leased product—are still being debated. But the direction of travel is clear. The businesses that will thrive are the ones that see accounting not as a barrier to circular innovation, but as the very tool that can measure and validate its success.

They’re the ones building the ledger for a world without waste. A ledger that accounts for more than just money, but for materials, longevity, and sustained value. That’s the real bottom line.