Let’s be honest. For a startup founder, the word “accounting” can feel about as exciting as watching paint dry. It’s a necessary evil, a back-office chore. But what if I told you that buried within your financials is a potential goldmine? A way to get significant cash back from the government for the very innovative work that keeps you up at night?

That’s the reality of R&D tax credits and other government innovation incentives. They’re not just for big pharma or aerospace giants. In fact, startups are often the perfect candidates. The trick is understanding how to account for them properly—turning a complex incentive into real, usable fuel for your growth.

It’s Not Just Lab Coats and Beakers: What Actually Qualifies as R&D?

First things first. Let’s ditch the stereotype. You don’t need a sterile lab. The definition of “research and development” for tax purposes is beautifully broad. It’s about the pursuit of technological or scientific uncertainty.

Are your developers creating a new algorithm? That’s R&D. Are you engineering a novel material for a sustainable product? R&D. Are you iterating on a unique software architecture to solve a problem no one else has? You guessed it—that’s very likely R&D.

The core question is: are you attempting to advance knowledge or capability in a field of science or technology, and isn’t the outcome a foregone conclusion? If you’re facing technical roadblocks and problem-solving your way through them, you’re probably in the zone.

Common Startup Activities That Often Qualify

- Developing new, improved, or more reliable software, processes, or formulas.

- Prototyping, testing, and iterating on product designs.

- Automating internal systems in a novel way.

- Integrating new technologies in a way that isn’t standard practice.

- Hiring engineers, data scientists, or technical designers to solve these challenges (their salaries are a huge part of the claim!).

The Accounting Tightrope: Expense or Windfall?

Here’s where many startups, and honestly even their accountants, get tripped up. How do you actually record this benefit in your books? The accounting treatment can feel like walking a tightrope between two different philosophies.

You have two main paths, and the choice has real implications for how your financial health looks.

The “Above the Line” Method (Reducing Expenses)

Think of this as the direct approach. You treat the R&D tax credit as a reduction of your research and development expenses. It lowers your P&L costs, which in turn makes your net income look better. It’s straightforward. Investors scanning your income statement see a healthier bottom line right away.

The “Below the Line” Method (Credit Against Tax)

This is the more traditional route. The credit is treated as a direct offset against your income tax liability. It shows up on the balance sheet as a receivable (if you’re owed a refund) or reduces your tax payable. The key nuance? It doesn’t artificially inflate your operational profitability. Your R&D spend stays on the books, showing the true cost of your innovation hustle.

So which is better? Well, it depends. For early-stage startups with little to no tax liability, the credit often results in a refundable cash payment. In that case, treating it as a tax credit (below the line) that becomes a receivable makes intuitive sense. It’s literally cash coming in.

Beyond the Federal Credit: Navigating the Incentive Maze

The federal R&D credit is the big one, but it’s just the entrance to a whole maze of potential incentives. Governments at all levels want to spur innovation. Accounting for these gets… interesting.

You might have:

- State R&D Credits: Some are refundable, some aren’t. Some require their own separate, meticulous calculation.

- Grant Funding: A non-dilutive cash infusion, sure, but often with strict conditional accounting. Is it income? A deferred liability? You need to track spending against milestones.

- Innovation Box Regimes (Patent Box): In some jurisdictions, profits from patented innovations are taxed at a lower rate. This is advanced, but something to grow into.

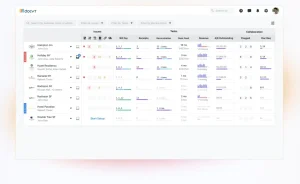

| Incentive Type | Accounting Consideration | Cash Flow Impact |

| Federal/State R&D Credit | Credit against tax or reduce expenses? Track qualified wages/supplies. | Often refundable for startups; major cash source. |

| Government Grants | Deferred income; recognize as conditions are met (milestones). | Upfront or milestone-based cash inflow. |

| Tax Exemptions | Directly reduces tax expense on P&L. | Indirect, via reduced tax payments. |

A Founder’s Action Plan: Don’t Leave Money on the Table

Okay, so this is complex. But complexity is just an opportunity in disguise. Here’s a practical, step-by-step approach to get this right.

1. Track Religiously From Day One

You can’t claim what you can’t prove. Implement a system—it can be simple at first—to track time and costs against specific technical projects. Which developer spent how many hours trying to solve that scalability issue? What did the cloud hosting for that testing phase cost? This detail is your evidence.

2. Integrate Incentives Into Financial Planning

Don’t treat this as a yearly surprise. Model potential credit amounts into your runway projections. That refund could extend your cash by critical months. It should be a line item in your financial model, not a footnote.

3. Find the Right Expertise

Your generalist CPA might not be enough. Look for an accountant or firm with specific experience in startup R&D tax credit claims. They’ll know the nuances of the “startup provision” and how to position your work. It’s an investment that pays for itself many times over.

4. Document the Journey, Not Just the Destination

The tax authorities love a good story. Not a novel, but a clear narrative. Maintain project notes, meeting minutes, or even a simple log that documents the technical challenges, hypotheses, and experiments. This creates a credible audit trail that shows the genuine uncertainty you were tackling.

The Bigger Picture: Incentives as a Strategic Asset

Ultimately, thinking about these incentives is about more than just accounting compliance. It’s about reframing your innovation spend from a pure cost center to a partially subsidized strategic investment.

When you account for them properly, you get a truer picture of your cost of innovation. You can make more informed decisions about hiring that extra engineer or pursuing a risky technical sprint. It de-risks the very act of pushing boundaries.

That’s the real secret. In the high-stakes game of startup growth, R&D tax credits and government incentives aren’t just a nice-to-have. They’re a tool to level the playing field. They turn the daunting cost of breaking new ground into a calculated, and even government-supported, bet on your own bright idea. And that’s an accounting story worth telling.