Let’s be honest. The old model of accounting—the fluorescent-lit office, the towering stacks of paper returns, the frantic scramble from January to April—it’s not just exhausting. It’s fragile. When the world shifts overnight, as it has a habit of doing, practices built on physical presence and manual processes crack under the pressure.

That’s where the real opportunity lies. Building a sustainable accounting practice today isn’t about working harder in the same old system. It’s about building something resilient, adaptable, and honestly, more human. The secret? Intentionally weaving together two powerful threads: a remote-first operational mindset and strategic workflow automation.

Why “Remote-First” is More Than Just Working From Home

First, a quick distinction. “Remote-friendly” means you allow people to work elsewhere. “Remote-first” means your entire workflow is designed for a distributed team. It’s the difference between accommodating a trend and building a foundation on it. For accounting firms, this shift is a sustainability game-changer.

Think about talent. Suddenly, your hiring pool isn’t limited to a 30-mile radius. You can find that perfect specialist in forensic accounting or that brilliant bookkeeper who prefers a mountain town. This access to a wider talent market is, frankly, a massive competitive edge. It also promotes continuity—life events or a move don’t necessarily mean losing a key team member.

Then there’s overhead. The savings on physical office space, utilities, and supplies are obvious. But the deeper sustainability win is in operational resilience. Your practice isn’t tied to a location. A snowstorm, a local power outage, a pandemic—these events become inconveniences, not existential threats. Your workflow just… continues.

Automation: The Engine That Makes Remote-First Actually Work

Here’s the deal, though. You can’t just send everyone home with a laptop and expect magic. In fact, without the right systems, a remote setup can descend into chaos—missed deadlines, version control nightmares, client documents floating in email purgatory.

This is where automation comes in. It’s the glue and the engine. It takes repetitive, low-value tasks off your team’s plate and creates a consistent, trackable process that everyone, anywhere, can follow. It turns a collection of remote workers into a synchronized firm.

Key Areas to Automate for a Frictionless Practice

You don’t need to automate everything at once. Start with the tasks that are repetitive, prone to human error, and frankly, soul-crushing. Here are a few prime candidates:

- Client Onboarding & Data Collection: Use a secure portal that automatically sends intake forms, engagement letters for e-signature, and connects to bank feeds or document request tools. No more chasing clients for PDFs over email.

- Transaction Coding & Reconciliation: Leverage AI-powered tools within your accounting software. They learn from your corrections and get smarter over time, flagging only the exceptions for human review. This is a huge time-saver.

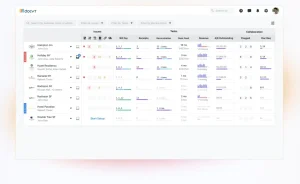

- Workflow & Task Management: Implement a practice management platform. It can auto-assign tasks based on rules (e.g., “all 1040s go to Tax Prep queue”), send reminders, and give everyone visibility into deadlines and bottlenecks. It’s your virtual office whiteboard.

- Reporting & Client Communication: Schedule monthly financial reports to generate and send automatically. Use email automation for check-ins or tax deadline reminders. It makes clients feel cared for, without you manually sending 100 emails.

Weaving It All Together: A Day in the Life, Transformed

Imagine this. A senior accountant, let’s call her Maria, logs in. Her dashboard in the practice management software shows her prioritized tasks, pulled directly from the automated workflow. A client’s bookkeeping is ready for review because the AI did the first pass. She reviews, makes a few adjustments, and the system automatically notifies the junior associate that the file is ready for the next step.

Meanwhile, a new client inquiry came in overnight. They filled out the automated web form, which triggered a sequence: a welcome email, a Calendly link to book a discovery call, and a pre-meeting questionnaire dropped into the CRM. The partner can see all this before hopping on the Zoom call.

No one is searching through email threads for a document. No one is wondering what’s due tomorrow. The work flows. It’s sustainable because it’s predictable and efficient, reducing burnout and creating capacity for the high-value advisory work clients truly need.

The Human Touch in a Digital Framework

A common fear—and it’s a valid one—is that this sounds cold. Automated. Robotic. But honestly, the opposite is true. By automating the repetitive stuff, you free up your most finite resource: human attention.

Your team can spend less time on data entry and more time interpreting what that data means for the client’s business. They can have strategic conversations instead of administrative ones. The technology handles the transactions; your people provide the translation and the insight. That’s where real client relationships are built and sustained.

Getting Started: It’s a Marathon, Not a Sprint

Feeling overwhelmed? Don’t. You don’t need a six-figure tech stack on day one. Start with a single, painful process. Is client onboarding a mess? Automate that first. Is reconciling credit card statements eating up hours? Find a tool that helps.

The goal is incremental progress. Choose one cloud-based core system (like a practice management suite) and integrate other tools into it. Seek out tools that talk to each other—that’s the magic. And critically, involve your team. They know the pain points best. Their buy-in is what turns a new software into a new, better habit.

Building a sustainable accounting practice in this era is less about counting beans and more about designing a garden—a system where the right tools (automation) and the right environment (remote-first) allow your team and your clients to thrive, season after season, no matter what the weather brings. The future of the profession isn’t just digital; it’s deliberately designed.