Let’s be honest. For many traditional accounting firms, the words “crypto” and “blockchain” still trigger a mild sense of dread. It feels like a whole new language, a wild frontier of volatile assets and tech jargon. But here’s the deal: ignoring it is no longer a viable strategy. Your clients are diving in—maybe as investors, maybe by accepting payments, maybe through NFTs. And they’re coming to you with questions.

The good news? You don’t need to become a cryptography expert. You just need to translate the principles you already know into this new context. Think of it like learning to drive on the other side of the road. The rules of the road—accruals, reconciliation, audit trails—are all still there. You’re just navigating a different landscape. Let’s break down what practical blockchain accounting really looks like.

Why This Isn’t Just a Niche Anymore

First, let’s address the elephant in the room. Is this really a priority? Well, consider the signals. Major financial institutions are offering crypto custody. FASB has issued new accounting standards for crypto assets. And frankly, your mid-market business client might be using blockchain for supply chain tracking without even calling it that. The lines are blurring.

The pain point is clear: clients need guidance on crypto tax compliance and financial reporting, and they’re getting patchy advice from forums and influencers. That’s a massive trust gap—and a massive opportunity for the firm that steps up. It’s about future-proofing your practice, plain and simple.

The Core Mindset Shift: From Ledger to… Ledger

This is the key analogy. You’ve spent your career trusting centralized ledgers—bank statements, broker reports. Blockchain, at its heart, is just a decentralized, immutable ledger. It’s public, it’s permanent, and it’s verified by a network, not a single entity. Your job shifts from relying on a third-party’s report to directly verifying transactions on a public record.

It’s a powerful shift. The audit trail is, in theory, more robust. But accessing and interpreting it requires new tools and a dash of new understanding. You’re moving from being a pure historian of financial data to something closer to a forensic explorer of it.

Where to Start: The Three Pillars of Crypto Accounting

Okay, so where do you actually begin? Focus on these three pillars to build a practical service offering.

1. Classification & Valuation: What Is It, Really?

This is arguably the most critical step. Not all crypto is created equal for accounting purposes. You need to ask: What is this asset?

| Common Classification | Accounting/Tax Implication | Example |

| Intangible Asset | Subject to impairment losses (under old guidance), no upward revaluation. Huge for corporate holders. | Bitcoin held as a treasury reserve. |

| Inventory | Valued at lower of cost or market. For active traders or exchanges. | Tokens held for sale by a crypto business. |

| Security | Complex. Might involve equity accounting or fair value through P&L. | Certain tokens with profit-sharing features. |

Valuation, honestly, is its own beast. You’re dealing with 24/7 markets and massive volatility. Establishing a consistent, defensible valuation policy—especially for illiquid tokens—is a core service you can provide.

2. Transaction Capture & Reconciliation

This is the gritty, daily work. Clients don’t just buy Bitcoin on Coinbase anymore. They’re yield farming, staking, swapping on decentralized exchanges, and receiving airdrops. Each event is a taxable and bookkeeping event.

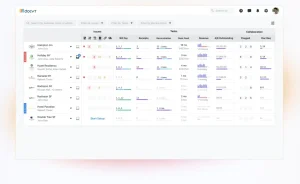

The challenge? Data is scattered across dozens of platforms, many with terrible export functions. Manual entry is a nightmare. The practical solution is specialized blockchain accounting software. These tools connect to exchanges and, crucially, read wallet addresses to pull in on-chain activity. They categorize transactions and can calculate cost basis and gains.

Your role becomes that of a verifier and interpreter. You’re using the software, sure, but you’re also reconciling its output against the immutable blockchain record. It’s about control and accuracy.

3. Compliance & Reporting: Navigating the Gray

Regulations are, let’s say, evolving. But the core requirements aren’t. You still need to report income (staking rewards are income, by the way!), capital gains, and proper disclosures. The new FASB rules help on the corporate reporting side, requiring fair value measurement for many holdings.

The real value you add is in interpretation. Helping a client understand the tax implications of a hard fork. Advising on the financial statement presentation of their digital assets. Drafting internal controls for managing private keys—which are, you know, essentially the cash of the crypto world.

Building Your Firm’s Capability: A Phased Approach

You don’t need to overhaul your firm tomorrow. Here’s a sensible, low-risk path.

- Phase 1: Educate & Tool Up. Pick one or two team members to deep-dive. Have them get hands-on with a crypto wallet and a major accounting platform’s crypto module. Understand the workflow from transaction to report.

- Phase 2: Pilot with a Friendly Client. Find a patient, crypto-active client. Offer a focused engagement to clean up their 2024 tax reporting or do a one-off financial review. You’ll learn more from this than any webinar.

- Phase 3: Formalize & Scale. Develop a standard workflow, checklists, and engagement letters. Decide on your service stack—which software you’ll standardize on. Then, market it to your existing client base as a new, specialized assurance service.

The Human Element: Talking to Clients About Risk

This might be your most crucial service. Clients often see the upside; you need to help them see the operational risks. It’s not just price volatility.

We’re talking about custody risk (lose your private key, lose your assets forever), regulatory risk, and fraud risk. Your advisory role expands. You become the voice urging cold storage solutions, multi-signature protocols, and rigorous internal controls. You’re not just accounting for the asset; you’re advising on how to safeguard it. That’s incredibly valuable.

Wrapping Up: The Trust Hasn’t Changed

At the end of the day, the core of your profession remains unchanged. Clients trust you to make sense of complexity, to ensure compliance, and to provide clarity. The tools and the assets are new, but that fundamental promise—the promise of accuracy, insight, and stewardship—is timeless.

Blockchain and crypto accounting isn’t about chasing a fad. It’s about extending the bedrock principles of your practice into the next evolution of value. It’s about meeting your clients where they are—and where they’re going. The ledger still matters. It just looks a little different now.