Let’s be honest—running a telehealth practice feels like juggling. You’re managing patient care across state lines, wrestling with ever-changing tech platforms, and trying to keep the lights on. And then there’s the bookkeeping. It can feel like trying to fit a square peg into a round hole if you’re using generic accounting methods.

Here’s the deal: remote healthcare isn’t just medicine at a distance. It’s a fundamentally different business model. And that demands a fundamentally different approach to your finances. Specialized accounting for telehealth providers isn’t about fancy software; it’s about understanding the unique rhythm of your revenue, your specific costs, and the regulatory tightrope you walk every day.

Why Your Practice Isn’t a “Regular” Medical Office (Financially Speaking)

Sure, you bill for services. But the similarities start to fade pretty quickly. Think of a traditional clinic: its financial map is drawn by physical geography—rent, utilities, front-desk staff, medical supplies for exam rooms. Your map? It’s digital. Your major costs live in the cloud.

This shift creates distinct accounting categories—and headaches. For instance, how do you categorize the subscription fee for your HIPAA-compliant video platform? Is it “software,” “office expense,” or a direct “cost of care”? The answer impacts everything from your profit margins to your tax strategy. Getting it right from the start is, well, critical.

The Core Pillars of Telehealth-Focused Accounting

Okay, let’s dive in. What actually makes accounting “specialized” for this field? It boils down to three pillars.

1. Revenue Recognition & Multi-State Complexity

Your income isn’t always straightforward. You might have direct patient payments, insurance reimbursements (each with its own lag time and denial rate), and maybe even subscription-based care models. Recognizing revenue accurately means tracking it by state due to licensing and tax nexus rules. A payment from a patient in California is a different line item than one from Texas, both for compliance and for understanding your market reach.

2. Tech-Stack Cost Allocation

Your tech stack is your clinic. Accounting needs to dissect it:

- Direct Patient Care Platforms: Video conferencing, secure messaging.

- Operational Backbone: EHR/Practice Management software, patient scheduling tools.

- Cybersecurity & Compliance: HIPAA-compliant hosting, data encryption services.

- Patient Acquisition: Website maintenance, digital marketing costs.

Allocating these costs correctly is huge. It shows you the true profitability of your service lines and is vital if you ever seek funding or want to sell the practice.

3. Compliance & Regulatory Navigation

This is the big one. Telehealth sits at a wild intersection of healthcare law (HIPAA, HITECH) and multi-state business regulations. Your accounting system must document compliance efforts—like proof of secure data handling—because those aren’t just good practices; they’re financial safeguards against massive fines.

Common Financial Pitfalls (And How to Sidestep Them)

Many remote health providers trip over the same hurdles. Seeing them coming is half the battle.

Pitfall #1: Blurring Personal and Business Finances. It’s so easy when you’re a solo practitioner starting out. But mixing funds makes tracking deductible business expenses a nightmare and can jeopardize your corporate liability shield. Get a dedicated business account yesterday.

Pitfall #2: Misclassifying Employees vs. Contractors. Using virtual assistants or contract clinicians? Misclassification can lead to brutal back taxes and penalties. The rules are strict and the IRS is watching this space closely.

Pitfall #3: Underestimating “Invisible” Costs. That $29/month app, the payment processor fees per transaction, the constant need for staff training on new software—they add up silently, like a slow drip eroding your revenue floor.

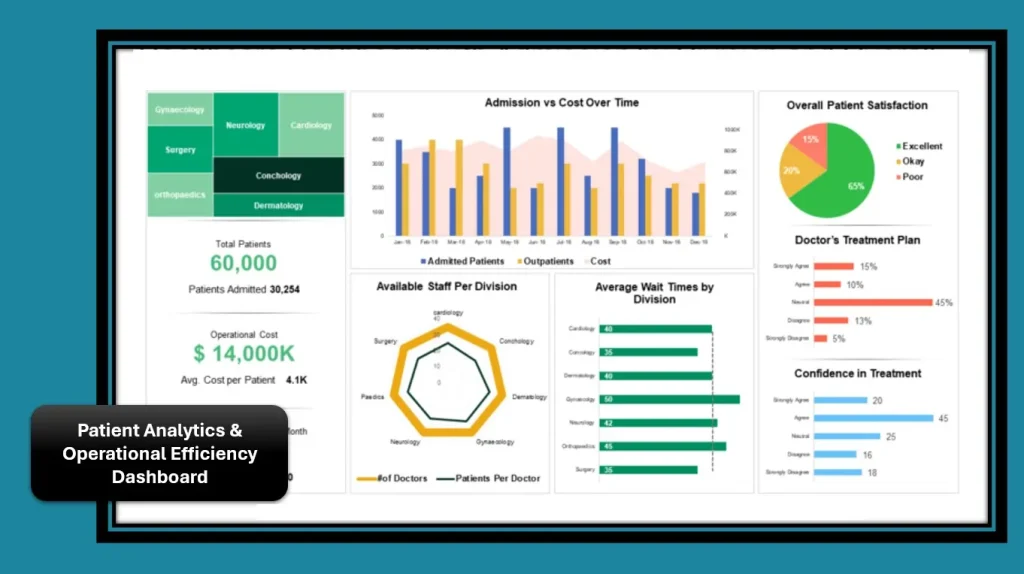

A Snapshot: Key Financial Metrics for Telehealth

What should you measure? Forget just “profit.” These metrics tell the real story of your telehealth practice’s health.

| Metric | What It Is | Why It Matters for Telehealth |

| Cost of Care Delivery (per encounter) | All direct costs to deliver a patient session (platform fee prorated, clinician time, allocated support). | Reveals true profitability per service type. Is that 15-minute follow-up actually costing you more than you bill? |

| Patient Acquisition Cost (PAC) | Total marketing spend / New patients acquired. | Digital marketing is a major line item. This tells you if your growth spend is sustainable. |

| Revenue Cycle Velocity | Average time from service to paid reimbursement. | Telehealth can be faster, but payor delays still hurt cash flow. Tracking this highlights billing process inefficiencies. |

| Technology ROI | Value gained from a tech tool vs. its cost. | Is that expensive new EHR module actually saving admin time or improving collections? Or is it just shiny? |

Making It Work: Practical First Steps

This might feel overwhelming. Don’t panic. Start here.

- Segregate Your Expenses. Create clear chart-of-accounts categories for Technology, Compliance, Digital Marketing, and Professional Fees (like licensing boards in multiple states).

- Implement Rock-Solid Time Tracking. For clinicians and support staff. This isn’t just for payroll; it’s the data you need to allocate labor costs accurately to different services or administrative tasks.

- Automate What You Can. Use tools that connect your practice management software to your accounting software (like QuickBooks Online or Xero). Reducing manual entry cuts errors and saves precious time.

- Consult a Pro (Seriously). Find an accountant or firm that has other telehealth clients. They’ll know the questions you haven’t even thought to ask yet—about sales tax on digital services across states, about R&D credits for developing proprietary care protocols, you name it.

Honestly, the goal isn’t perfect, robotic bookkeeping. It’s financial clarity. It’s knowing, with certainty, which services are your engines of growth and which are quietly draining resources. It’s building a financial foundation that’s as agile, compliant, and forward-looking as the care you provide.

In the end, specialized accounting for remote healthcare lets you stop worrying about the numbers… so you can get back to what actually matters. Connecting with patients, wherever they are.